Insurance is a financial safety net that protects individuals, families, and businesses from unexpected losses. With so many types of insurance available, it can be overwhelming to determine which policies you need. This comprehensive guide breaks down the major categories of insurance, their benefits, and who should consider them.

Table of Contents

- Introduction to Insurance

- Auto Insurance

- Health Insurance

- Life Insurance

- Homeowners & Property Insurance

- Business Insurance

- Travel Insurance

- Disability Insurance

- Pet Insurance

- Specialty Insurance (Niche Policies)

- How to Choose the Right Insurance

- Common Insurance Mistakes to Avoid

- The Future of Insurance

- Final Thoughts

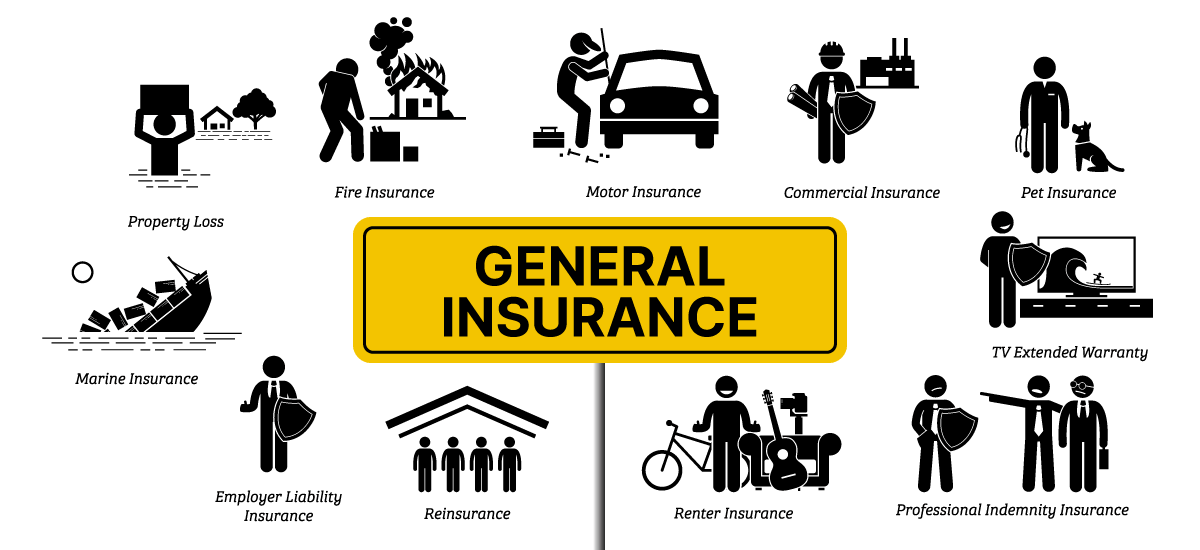

1. Introduction to Insurance

Insurance is a risk management tool that provides financial compensation in case of accidents, illnesses, property damage, or death. Policyholders pay premiums to an insurance company, which then covers losses as per the agreed terms.

Why Is Insurance Important?

✔ Financial Protection – Prevents large out-of-pocket expenses.

✔ Legal Requirement – Some types (like auto insurance) are mandatory.

✔ Peace of Mind – Reduces stress in emergencies.

✔ Asset Protection – Safeguards homes, cars, and businesses.

2. Auto Insurance

What It Covers:

- Collision Damage – Repairs after an accident.

- Liability Coverage – Pays for injuries/property damage you cause.

- Comprehensive Insurance – Covers theft, fire, natural disasters.

- Uninsured Motorist Protection – If the at-fault driver has no insurance.

Who Needs It?

- All drivers (legally required in most states).

- Leased/financed car owners (often required by lenders).

Average Cost:

- 1,500–1,500–2,500/year (varies by driving record, location, and coverage).

3. Health Insurance

Types of Health Insurance:

- Employer-Sponsored Plans (most common).

- Individual Plans (purchased privately).

- Medicare (for seniors 65+).

- Medicaid (for low-income individuals).

- Short-Term Plans (temporary coverage).

Key Benefits:

✔ Covers doctor visits, hospital stays, prescriptions.

✔ Prevents massive medical debt.

Average Cost:

- 300–300–1,200/month (depends on plan type and deductibles).

4. Life Insurance

Types of Life Insurance:

- Term Life – Affordable, temporary coverage (10–30 years).

- Whole Life – Permanent coverage with cash value.

- Universal Life – Flexible premiums and benefits.

Who Needs It?

- Parents (to secure children’s future).

- Homeowners (to cover mortgage debt).

- Business owners (for key-person insurance).

Average Cost:

- Term Life: 20–20–50/month.

- Whole Life: 100–100–500/month.

5. Homeowners & Property Insurance

Coverage Includes:

- Dwelling Protection (house structure).

- Personal Property (furniture, electronics).

- Liability Coverage (if someone gets hurt on your property).

- Additional Living Expenses (if home is uninhabitable).

Who Needs It?

- Homeowners (required by mortgage lenders).

- Renters (protects personal belongings).

Average Cost:

- 1,000–1,000–3,500/year (varies by location and home value).

6. Business Insurance

Common Business Insurance Types:

- General Liability Insurance (lawsuits, injuries).

- Workers’ Compensation (employee injuries).

- Commercial Auto Insurance(business vehicles).

- Professional Liability (E&O) (for service providers).

Who Needs It?

- Small business owners.

- Freelancers & consultants.

Average Cost:

- 500–500–5,000/year (depends on business size).

7. Travel Insurance

What It Covers:

- Trip Cancellation (due to illness or emergencies).

- Medical Emergencies Abroad(hospital bills overseas).

- Lost Luggage (reimbursement for stolen/delayed bags).

Who Needs It?

- International travelers.

- Those with expensive pre-paid trips.

Average Cost:

- 4–10% of total trip cost.

8. Disability Insurance

Types:

- Short-Term Disability (3–6 months coverage).

- Long-Term Disability (years or lifetime coverage).

Who Needs It?

- Working professionals (replaces lost income if injured).

Average Cost:

- 1–3% of annual salary.

9. Pet Insurance

What It Covers:

- Vet visits, surgeries, medications.

Who Needs It?

- Pet owners (especially for expensive breeds).

Average Cost:

- 30–30–70/month per pet.

10. Specialty Insurance (Niche Policies)

- Wedding Insurance (cancellation coverage).

- Cyber Insurance (data breach protection).

- Event Insurance (for concerts, festivals).

11. How to Choose the Right Insurance

✔ Assess Your Needs (family, assets, risks).

✔ Compare Quotes (get at least 3–5 estimates).

✔ Check Insurer Reputation (BBB, J.D. Power ratings).

✔ Understand Policy Exclusions(what’s NOT covered).

12. Common Insurance Mistakes to Avoid

❌ Underinsuring (too little coverage).

❌ Ignoring Deductibles (high deductibles = lower premiums).

❌ Not Updating Policies (life changes require adjustments).

13. The Future of Insurance

- AI & Big Data (personalized premiums).

- Pay-Per-Mile Auto Insurance (for low-mileage drivers).

- On-Demand Insurance (short-term coverage via apps).

14. Final Thoughts

Insurance is essential for financial security. Evaluate your risks, compare policies, and choose coverage that fits your lifestyle and budget.

Have questions about insurance? Drop them in the comments! 🚗🏠💼